Founded in 2015 DAZN employs 3000 people globally. DAZN is owned by three principal shareholders – Access Industries, Dentsu and Aser – and has benefitted from $6 billion equity investment over the course of its eight-year existence.

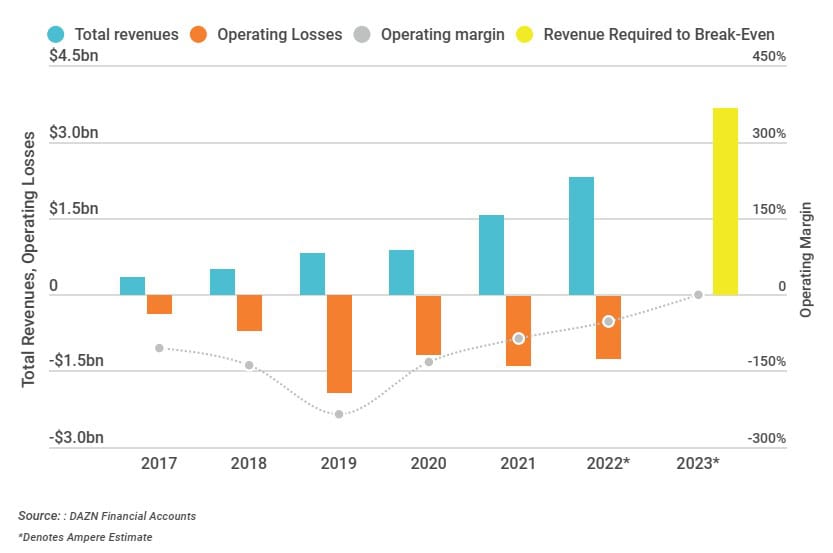

Such significant investment has naturally brought the focus onto how soon DAZN will reach their break-even financial milestone. Ampere Analysis carried analysis in this area a couple of years ago. Now perhaps we can see how accurate their estimates were. Previously they stated that:

“Given that we expect DAZN’s rights spend to increase by a further 6% in 2023, revenues will need to increase notably for DAZN to reach profitability. Higher pricing helps: since 2021, DAZN has been raising its prices in most of its markets – resulting in an ARPU growth of 77% in its core markets, with only moderate impact on churn levels.

Ampere estimates that, in 2023, subscriptions will account for 80% of DAZN’s total revenues, with the rest equally split between advertising and other ventures. In order to break even by the end of 2023, therefore, DAZN would need to grow subscriptions revenue by 34% (a lower annual growth rate than what it has achieved every year but one – 2020 – since it launched), while also generating $730m in advertising revenues and other activities. While this sounds ambitious, if we assume advertising accounted for half of this additional revenue DAZN would be generating only around a third of the advertising revenue generated by rival Sky from a broadly similar-sized subscriber base”.

It has been previously stated that DAZN has 20 million premium paying subscribers. The 2024 half year review for DAZN states:

“We are rapidly approaching 20 million paying subscribers each year, our content is viewed regularly by 300 million users and our expanding range of global and market specific content drives our ambition to reach one billion users globally”.

So the 20 million premium paying users milestone has not yet been reached. The full 2024 annual review will provide more conclusive evidence when it arrives. In any event the 1/15th (20 million) of the 300 million suggests an improvement is required for the conversion rate of users to premium users.